In the past we received several requests for the FIN05420 report to display relevant tax code for every transaction, particularly for postings on revenue accounts. This would allow users to perform a VAT reconciliation (compare revenue with booked VAT) with the report.

Until now it was only possible to display the VAT code for a transaction when it was displayed on the row level of the journal entry. This was only the case for VAT accounts and manual journal entries with option 'Autom. Tax' activated. For most other cases (e.g. Journal entries created by invoice postings or manual created journal entries without 'Autom. Tax' selected), the tax code would not be displayed on row level of the related revenue account. As a result, the transaction lines without a tax code were shown with 0% as VAT code in the FIN05420 journal transaction report.

The new setting "Split Journal Entry Posting by Document Lines" is unable to fulfill this request, as it does not change the VAT information which is stored in the journal entry on row level. Instead of showing the VAT information, the report would display every document row. Not only would this change cause a major performance issue, but the report would lose its usability.

For those reasons the decision was made to take the VAT column out of the FIN05420 report.

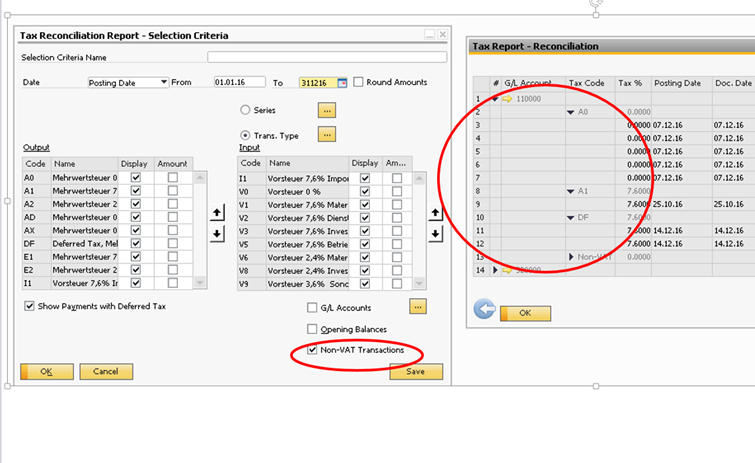

We suggest that the standard SAP report 'Tax reconciliation report' be used instead. The report displays the transactions by G/L account and by tax code. The 'display Non-Vat Transact.' parameter can then be selected to include the transactions without a VAT code. This allows a complete VAT reconciliation as requested by the users.

Comments

0 comments

Please sign in to leave a comment.